- Investment

What is the specific taxation on business transfer when selling a company?

- Wed, Sep 20, 2023 at 16:00

The specific taxation on business transfer: Understanding the mechanism and its advantages

Specific taxation on business transfer is a tax mechanism that offers attractive advantages on the capital gain from the sale of a business, for the entrepreneur who sells his company. This mechanism is governed by Article 150-0 B ter of the French General Tax Code (CGI), and is designed to optimize capital gains on the sale of company shares, while avoiding excessive tax burdens.

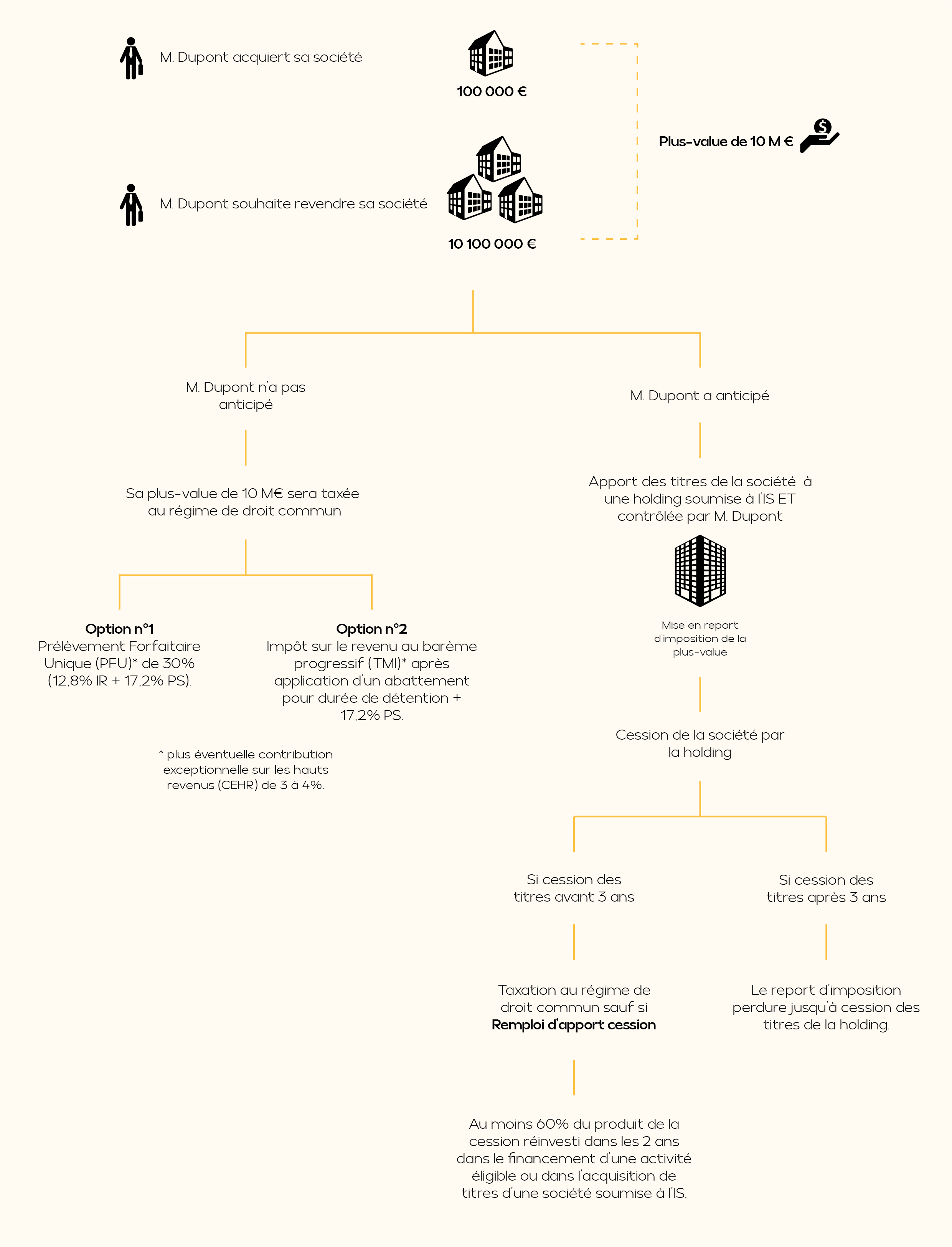

Disposals must be anticipated and monitored by experts, to avoid undesirable tax consequences.

If you don't plan ahead, the capital gain from the sale of company shares is subject to the 30% Prélèvement Forfaitaire Unique (PFU) or to the progressive tax scale. The "contribution-cession" mechanism is therefore as follows: defer payment of capital gains tax on the sale of shares in a company by reinvesting part of the proceeds of the sale in the purchase of new shares in companies eligible for this scheme.

To achieve this, an intermediate operation must be envisaged: the contribution to a holding company subject to corporation tax and controlled by the contributor. In exchange, he will receive shares in this holding company. This holding company then sells the company's shares to a third-party buyer. The advantage of this mechanism is that the capital gain calculated at the time of the contribution of the company's shares is not immediately taxed, but is placed on a tax deferral basis.

Deferral of capital gains tax on disposals

When the entrepreneur makes a contribution of shares, the capital gain realized must be deferred under certain conditions in order to maintain the tax deferral: at least 60% of the proceeds from the sale must be reinvested in eligible activities within 2 years of the sale, which must take place within 3 years of the contribution.

After 3 years, the tax deferral applies automatically, and the holding company can reinvest 100% of the proceeds in one or more activities of its choice.

It should be remembered that this specific taxation on business transfer provides for a deferral of taxation, and not a definitive exemption of the capital gain on the contribution, which may be taxable one day.

Specific taxation on business transfer with U'wine Grands Crus 4

Thanks to its economic and legal model, U'wine Grands Crus 4 (UWGC 4) is an investment eligible for this mechanism, secured by tangible assets and liquidity on exit. Our shareholders also have access to the U'wine Experience.

What are the terms and conditions of our UWGC 4 offer, which is eligible for the specific taxation on business transfer ?

UWGC 4 is a Bordeaux-based trading company dedicated to raising funds to buy en primeur and allocation wines and resell them at their highest sales potential between the third and sixth year.

Benefits of subscribing to UWGC 4 capital

1- Security provided by the asset : 80% of the capital raised is converted into the purchase of Grands Crus ;

2- Opportunities for tax relief : Income tax reduction, PEA/PEA-PME, specific taxation on business transfer ;

3- Optimized capital withdrawal : Shareholders withdraw from the company on the 1st day of the 9th financial year, via a repayment of each shareholder's contribution and payment of the liquidation surplus. Subject to available cash, the limited partners will receive a refund of their contribution and 85% of the liquidation bonus, in accordance with the conditions set out in the company's articles of association. If, and only if, there are any remaining stocks of bottles of wine, shareholders* will have the option of being reimbursed in part in bottles under certain conditions ;

4- The investor's commitment period is 8 years to optimize the profitability of his investment ;

5- Performance objective : view the Summary Information Document

*Excluding PEA - PEA PME