- Investment

Wine, the fun investment to diversify your assets

- Thu, Apr 13, 2023 at 10:00

A complicated context

The beginning of 2023 continues the logic of previous years: a context of economic crisis and many instabilities for savers to find a safe investment with a certain profitability. Indeed, it was interesting to invest in real estate in the last few years as prices tended to increase and loans had never been so interesting. However, this trend has changed considerably in recent months with loan rates now exceeding 3% over 20 years and a usury rate that will now be reviewed every 6 months. In addition, the implementation of the Climate Law on 1 January 2023 aims to prohibit the rental of housing that does not comply with energy standards, forcing owners to carry out work to bring it up to standard, while the costs of raw materials are rising sharply. In addition, rising energy costs are encouraging investors to opt for new properties that meet the latest energy and environmental standards.

Pleasure investment to diversify your assets

In this context, it is important to look at other investment options that may be more profitable. It may be wise to invest in fun assets such as classic cars, works of art, racehorses or historical monuments. These solutions are attracting new savers who are looking to invest differently. Among these investment categories, one sector is gaining momentum and attracting more and more enthusiasts: investment in wine.

U'wine: the pleasure of investing in wine

The wine sector is an example of a fun investment that can offer interesting returns even in times of crisis. The data shows that the wine sector is strengthening and becoming a real safe haven investment. For example, the index tracking the 150 best Burgundy wines has grown by an average of 12.3% per year between 2004 and 2021, compared to an average annual return of 11.1% for gold. Furthermore, the advantage of the pleasure investment in wine is that it offers value that cannot be measured only by its financial performance. It can be a financial, heritage, educational and emotional investment.

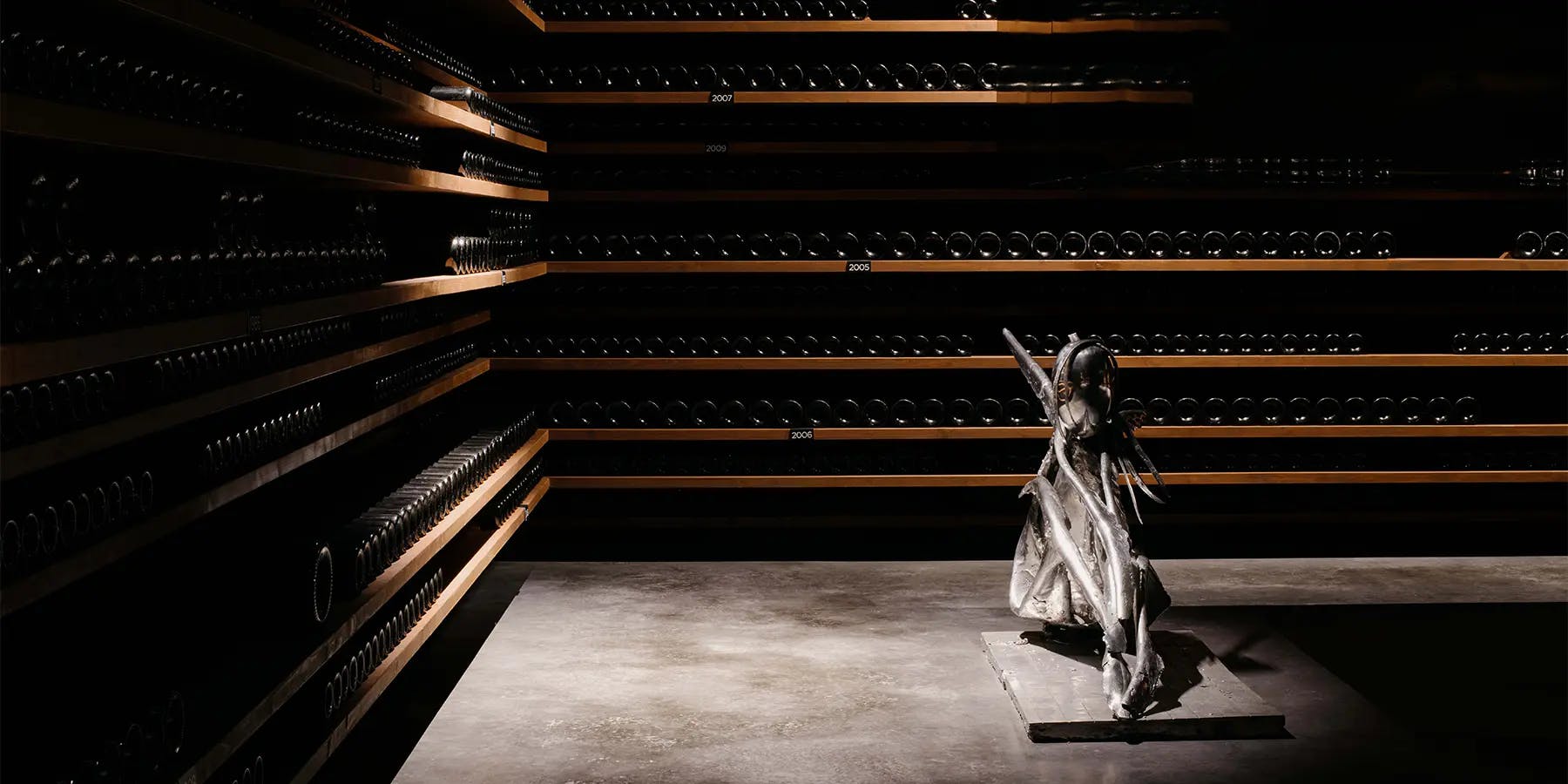

For the resale price to be optimal, it is essential that the bottles are stored in optimal conditions. For this reason, this solution is no longer only intended for enthusiasts with a personal wine cellar, since we now offer to store your wines in our cellars and deliver them to you when you wish. Furthermore, for an investment to be successful, the purchase price of the wines must be the best and our strength is to have direct access to Châteaux and Domaines, some of which are inaccessible.

These strengths have enabled us to pass a milestone of investment maturity and to have a record disinvestment rate for the year 2022. Our track record also remains excellent: a U'wine client achieves an average annual net performance of 4.6% for an average investment period of 6.5 years (all bottles and all investors combined).

Want to read the latest articles on this subject?