- Investment

4 tangible assets to invest in in 2024

- Thu, Jan 18, 2024 at 11:30

Property: a cornerstone of tangible investment

Property investment has long been recognised as one of the most reliable and profitable forms of tangible investment. Whether you opt to buy residential, commercial or seasonal rental property, real estate offers long-term stability and growth potential. By investing in property, you have the opportunity to generate passive rental income, benefit from property value appreciation and enjoy tax advantages. It is essential to carry out thorough research, assess the local property market and take into account the costs involved in maintaining and managing the property.

Forestry investment group shares: a tangible prospect

Shares in forestry investment groups are a promising and secure tangible investment option. Whether acquiring shares in forestry groups with an ecological vocation, wood production or biodiversity preservation, these investments offer stability and long-term growth potential. By investing in forestry group shares, investors have the opportunity to generate income from the sustainable exploitation of forestry resources, while benefiting from the enhancement of forest land. What's more, this type of investment can offer specific tax advantages. However, it is crucial to carry out in-depth analyses, evaluate the management of the forestry group, and take into account aspects relating to sustainability and environmental preservation.

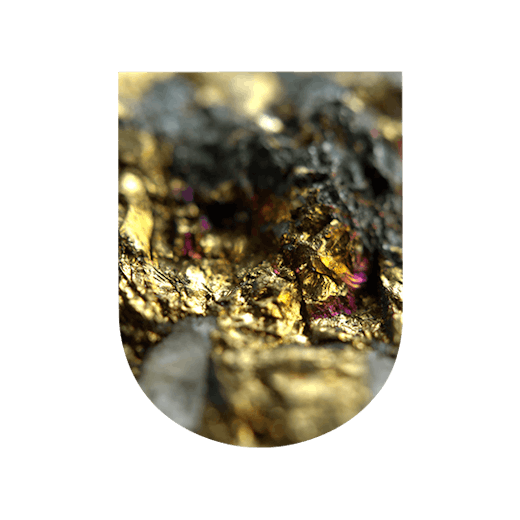

Precious metals: a safe haven in uncertain times

Precious metals, such as gold and silver, have always been regarded as safe havens in times of economic instability. As tangible investments, they provide protection against inflation, currency devaluation and financial market fluctuations. Gold, in particular, is valued for its intrinsic value and universal appeal, in the form of coins, bars or certificates. These metals can be held physically or via specialist investment funds, although their value can fluctuate according to global economic conditions and demand.

As we enter 2024, it is important to consider investment opportunities that offer stable and sustainable returns. While many sectors are evolving rapidly, certain items stand out for their potential for growth and stability. Among these opportunities, wine occupies a special place. Investing in wine can be a lucrative and exciting strategy, offering both attractive returns and the pleasure of tasting exceptional vintages.

Investing in wine: a promising goal

Wine has always been seen as a stable, long-term investment option. As a tangible asset, it derives its intrinsic value from its rarity, quality and reputation. Over time, the wine market has demonstrated its robustness and ability to generate attractive returns. What's more, wine is a diversified asset, with a variety of wine-growing regions, grape varieties and vintages, offering investors the chance to build up a varied cellar. Whether you are a passionate wine lover or an experienced investor, acquiring fine wines may prove to be a wise investment strategy in 2024.

Grands crus: a safe haven

In times of volatility on the financial markets, many investors turn to tangible assets with a reputation as valuable safe havens, including grands crus. Wines from renowned regions such as Bordeaux, Burgundy, the Rhône Valley and other prestigious regions have a long history of appreciation and stability. These grands crus are prized due to the growing demand from collectors, wine lovers and investors around the world. By investing in well-established grands crus, you have the opportunity to benefit from their long-term value enhancement potential, while revelling in the satisfaction of owning exceptional bottles.

Grand cru wines: combining pleasure and investment

Investing in grands crus goes beyond the simple quest for financial returns. It's also a sensory experience and a passion to be shared with other wine lovers. Tasting fine wines and building up a personal cellar can provide unparalleled personal satisfaction. Investing in wine offers the chance to combine pleasure and profitability, making it a unique choice among tangible investments. By acquiring knowledge of the various wine-growing regions, grape varieties and vintages, you can refine your palate and make informed decisions to enrich your wine collection. The main risk associated with wine investment lies in the liquidity of the assets, where the investor may find himself with all or part of his grands crus to enjoy, or waiting for the market to recover before considering reselling his wines.

For investors looking for diversification and stability in 2024, opting for tangible assets may be a wise strategy. Among the options available, investing in wine stands out as a promising choice, combining attractive returns with the pleasure of wine-tasting. In particular, grands crus offer a safe haven and stability in an uncertain economic climate. To get 2024 off to a flying start, how about investing in wine?